The solution depends on a number of aspects, consisting of where you live, how much your vehicle is worth, as well as what other assets you require to shield. Key Takeaways The majority of states need you to have at least a minimal amount of insurance protection for any kind of injuries or building damages you create in a crash.

Comprehensive coverage, additionally optional, secures versus other threats, such as theft or fire (insurers). Without insurance vehicle driver protection, compulsory in some states, shields you if you're struck by a vehicle driver who does not have insurance coverage. How Vehicle Insurance policy Works An auto insurance plan is in fact a package of several various sorts of insurance coverage.

In that instance, you'll desire to acquire more coverage. The nonprofit Consumers' Checkbook, amongst others, advises buying insurance coverage of at least 100/300/50, simply in instance.

It's stood for on your plan as the 3rd number because series, so a 25/50/20 policy would provide $20,000 in insurance coverage. Some states require you to have as low as $10,000 or perhaps $5,000 in home damages obligation insurance coverage, yet $20,000 or $25,000 minimums are most usual. Again, you may desire to purchase more protection than your state's minimum (cheapest auto insurance).

Our Automobile Insurance Ideas

A typically suggested degree of residential or commercial property damage protection is $50,000 or even more if you have significant assets to secure. Clinical Repayments (Medication, Pay) or Injury Security (PIP) Unlike physical injury responsibility coverage, clinical repayments (Medication, Pay) or accident protection (PIP) covers the cost of injuries to the vehicle driver and also any passengers in your car.

Whether clinical repayments or PIP insurance coverage is obligatory, optional, or perhaps offered will depend upon your state. business insurance. In states with no-fault insurance laws, such as Florida as well as New York City, PIP coverage is required. In Florida, for instance, vehicle drivers must carry at least $10,000. In New York, the minimum is $50,000.

If you do not have wellness insurance policy, nevertheless, you may desire to buy more. That's specifically true in a state like Florida, where $10,000 in coverage might be insufficient if you're in a serious accident. Accident Coverage Collision protection will certainly pay to fix or change your car if you're associated with a mishap with another auto or strike a few other item (cheap car).

When you have actually paid off your financing or returned your leased car, you can go down the protection. Also if it's not called for, you might desire to get crash coverage.

4 Simple Techniques For What Is The Most Important Car Insurance Coverage? - The ...

The rate of collision coverage is based on the value of your car, and also it typically includes a deductible of $250 to $1,000. If your vehicle would cost $20,000 to change, you would certainly pay the first $250 to $1,000, depending on the deductible you chose when you bought your policy, and the insurance provider would certainly be responsible for as much as $19,000 to $19,750 after that.

Between the cost of your annual costs and the deductible you would certainly have to pay out of pocket after an accident, you might be paying a great deal for really little coverage - cheapest. Also insurer will certainly tell you that dropping crash coverage makes sense when your auto deserves less than a couple of thousand dollars - business insurance.

As with detailed protection, states don't need you to have collision insurance coverage, yet if you have a car finance or lease, your loan provider may need it. And once more, when you have actually paid off your finance or returned your rented cars and truck, you can drop the insurance coverage.

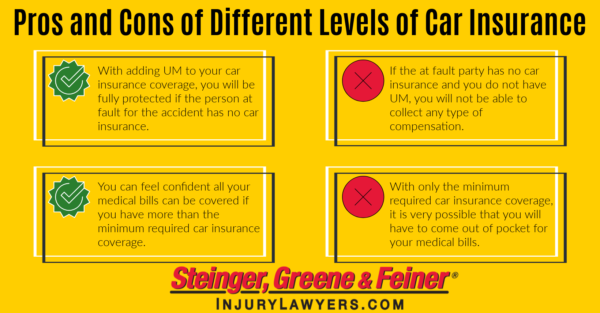

You'll also want to think about exactly how much your vehicle is worth contrasted with the expense of covering it year after year. Uninsured/Underinsured Driver Protection Just since state laws need drivers to have responsibility protection, that does not suggest every motorist does.

Some Ideas on Things To Know - Cnn Business You Should Know

That is where this kind of protection comes in. Some states need chauffeurs to carry without insurance motorist protection (UM).

If your state requires uninsured/underinsured motorist insurance coverage, you can buy more than the required amount if you wish to - cheaper auto insurance. You can likewise get this protection in some states that don't require it. If you aren't needed to purchase uninsured/underinsured vehicle driver coverage, you might intend to consider it if the insurance coverage you already have would certainly want to foot the bill if you're included in a serious mishap.

Other Sorts of Coverage When you're looking for automobile insurance coverage, you might see a few other, entirely optional sorts of coverage. Those can include:, such as towing, if you need to rent a vehicle while yours is being fixed, which covers any type of difference in between your vehicle's money worth and also what you still owe on a lease or lending if your cars and truck is a complete loss Whether you need any of those will depend upon what various other resources you have (such as subscription in a car club) and also just how much you can afford to pay of pocket if you must (cars).

Whether to acquire greater than the minimum required protection and also which optional sorts of insurance coverage to take into consideration will rely on the properties you need to secure in addition to just how much you can pay for to pay (insurance). Your state's automobile division site ought to clarify its demands and might provide other recommendations details to your state.

More About Vehicle Liability Insurance Requirements - State Department

A car insurance plan can include a number of different sort of coverage. Your independent insurance coverage agent will certainly give specialist suggestions on the kind and also quantity of vehicle insurance policy coverage you ought to have to satisfy your specific demands and abide by the laws of your state. Here are the primary kinds of protection that your plan might consist of: The minimal coverage for bodily injury varies by state and also may be as reduced as $10,000 per person or $20,000 per mishap.

If you harm somebody with your automobile, you might be taken legal action against for a whole lot of cash. The quantity of Liability coverage you lug ought to be high sufficient to protect your assets in case of a mishap. Most experts suggest a restriction of a minimum of $100,000/$300,000, but that may not be enough.

If you have a million-dollar home, you might lose it in a suit if your insurance protection is inadequate. You can get additional insurance coverage with an Individual Umbrella or Individual Excess Obligation policy. The better the worth of your properties, the more you stand to lose, so you require to acquire liability insurance coverage appropriate to the value of your assets - automobile.

You do not have to figure out just how much to purchase that depends on the lorry(s) you insure. You do require to make a decision whether to acquire it and also how huge an insurance deductible to take (affordable car insurance).

Our Ohio's Minimum Coverage Requirements For Auto Insurance Statements

If the automobile is only worth $1,000 and the deductible is $500, it might not make feeling to purchase crash insurance coverage. Accident insurance policy is not generally needed by state law. Covers the price of miscellaneous damages to your cars and truck not triggered by an accident, such as fire as well as theft. Just like Accident coverage, you require to select an insurance deductible.

Comprehensive coverage is typically sold together with Accident, and both are usually described with each other as Physical Damages protection. If the cars and truck is rented or financed, the renting company or loan provider may require you to have Physical Damages insurance coverage, even though the state legislation may not require it. Covers the expense of treatment for you and also your passengers in the event of a crash.

Therefore, if you choose a $2,000 Medical Expense Restriction, each passenger will certainly have up to $2,000 insurance coverage for medical insurance claims arising from a mishap in your lorry. If you are entailed in a mishap and the various other motorist is at fault however has insufficient or no insurance policy, this covers the void in between your costs as well as the various other chauffeur's insurance coverage, up to the limitations of your protection (automobile).

The limitations required and also optional restrictions that might be offered are established by state regulation. This insurance coverage, required by law in some states, covers your clinical prices as well as those of your travelers, despite who was responsible for the accident - cheapest. The limitations called for as well as optional limitations that may be offered are established by state legislation.

Examine This Report on Getting A Driver License: Mandatory Insurance - Dol.wa.gov

When it comes to auto insurance policy, the olden question is, How much automobile insurance coverage do I need? Should you simply obtain the most affordable choice? We're gon na shoot straight with you: Conserving money isn't the only part of buying automobile insurance coverage (money). You require protection that actually covers you, the kind that safeguards you from budget-busting cars and truck wrecks.

One of the huge factors it's tough to obtain the right protection is because, allow's encounter it, vehicle insurance is puzzling. For beginners, most motorists ought to have at least three kinds of car insurance coverage: responsibility, comprehensive as well as collision.

Why You Need Automobile Insurance policy Driving around without car insurance coverage is not just stupid with a funding D, it's additionally prohibited. Yet one in eight Americans drives without some kind of vehicle insurance policy in position.1 Do not do this. There are serious consequences if you're caught on the road without car insurance coverage.

We advise having at least $500,000 worth of overall insurance coverage that includes both types of responsibility coverageproperty damages responsibility and also bodily injury responsibility. car. This way, if a mishap's your mistake, you're covered for costs connected to repairing the various other chauffeur's automobile (building damages) and also any kind of expenses related to their lost incomes or medical costs (bodily injury).

Get This Report on 5 Types Of Car Insurance Coverage Explained - 21st.com

Here's what we claim: If you can not change your vehicle with cash, you need to obtain crash. The only time you may not need collision is if your cars and truck is paid off and, once again, you could replace it from your financial savings.

Currently, there are 22 states where you're either needed by regulation to have PIP or have the alternative to purchase it as an add-on insurance coverage.5 If you live in a state that requires you to lug PIP, you should maximize the coverage if you ever before need it - insurance.

Even though they would certainly be reducing you a rather big check, it still would not be adequate to pay off your loan. GAP insurance fills this "void" by covering the remainder of what you still owe on your funding.

If you assume you'll need this back-up strategy in position, it's not a negative idea to include this to your plan. Pay-Per-Mile Coverage If your automobile often tends to rest in the garage gathering dust, you may want pay-per-mile coverage. With this protection, a general practitioner device is mounted in your cars and truck so you're billed per mile, as opposed to a yearly quote. car.